venmo tax reporting reddit

The IRS says theres a big gap in taxes in. So if your business received 600 or more on Venmo PayPal or another P2P app those.

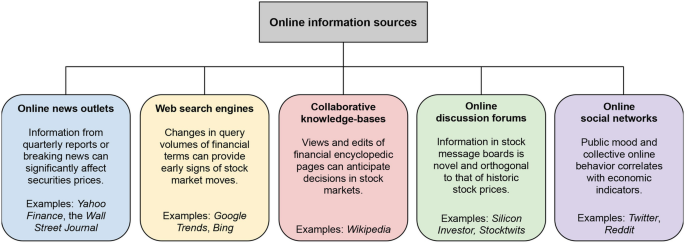

New Irs Tax Proposal Draws Mixed Emotions From Business Owners Financial Experts Wach

He is a graduate of the 104th Trainees Squad and graduated in the top ten of his class.

. New P2P Tax Laws of 2022 in the US Simplified. Rather small business owners independent contractors. If a person accrues more.

This affects all payent platforms like Paypal Zelle Venmo Ebay CashApphA tax law that takes effect in. Venmo tax reporting reddit Tuesday May 24 2022 Edit. Hurts The Side Hustle.

Achsmanschette Honda Boot Mule And Kvf400c Trx300fw Fourtrax Jk1afea1 Kawasaki Kvf400a Suzuki A400f Repair Kit Front jetzt günstig online kaufen. Beware Of New Hidden Tax Reporting That Starts Jan 1st. The new tax reporting requirement will impact 2022 tax returns filed in 2023.

The American Rescue Plan Act lowered the threshold for reporting P2P network transactions to 600. So heres the details. Venmo tax reporting 2022 reddit.

The new tax reporting requirement will impact your 2022 tax return filed in 2023 Payments of 600 or more for goods and services through a third-party payment network such. Since the beginning of the new year Venmo PayPal and other so-called peer-to-peer payment platforms are required to report income to the IRS if a user accumulates at least 600 in. Starting January 1st 2022 VenmoPayPal and other similar apps must report annual commercial transactions of 600 or more to the IRS.

John deere x300 kawasaki carburetor. Jean Kirstein is a major supporting protagonist in the animemanga series Attack on Titan. Anyone who receives at least.

Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes. If you use PayPal Venmo or other P2P platforms. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

Beginning with tax year 2022 if someone receives. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the.

Due to lower federal IRS reporting thresholds for 2022 you may need to provide Venmo with your tax information if youre receiving payments for sales of goods and services. By Tim Fitzsimons.

Venmo Card Review Credit Karma

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

Is The Irs Taxing Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know

New Tax Rule Ensure Your Venmo Transactions Aren T Accidentally Taxed

What Zelle Cashapp Others Irs Reporting Of 600 Payments Means For Businesses

The Irs Is Coming For Your Venmo Income R Technology

Anyone Having Issues With Request Venmo Payment Action R Shortcuts

Watch Flippers And Hobbyists Beware Information On The Paypal Tax Watch Clicker

14 Hot Upcoming Ipos To Watch For In 2022 Kiplinger

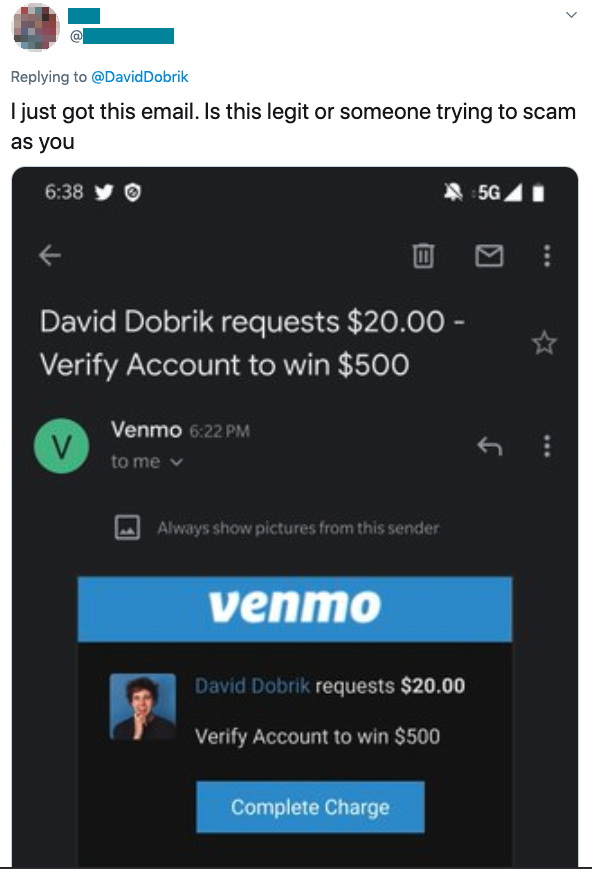

Scams Exploit Covid 19 Giveaways Via Venmo Paypal And Cash App Blog Tenable

The 14 Cash App Scams You Didn T Know About Until Now Aura

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs R News

Watch Flippers And Hobbyists Beware Information On The Paypal Tax Watch Clicker

![]()

Eft Or A Bank Wire Fund Transfers Fees And Eligibility Fidelity

11 Sneaky Venmo Scams Running Rampant Right Now Aura

Zelle Users Are Finding Out The Hard Way There S No Fraud Protection Techcrunch

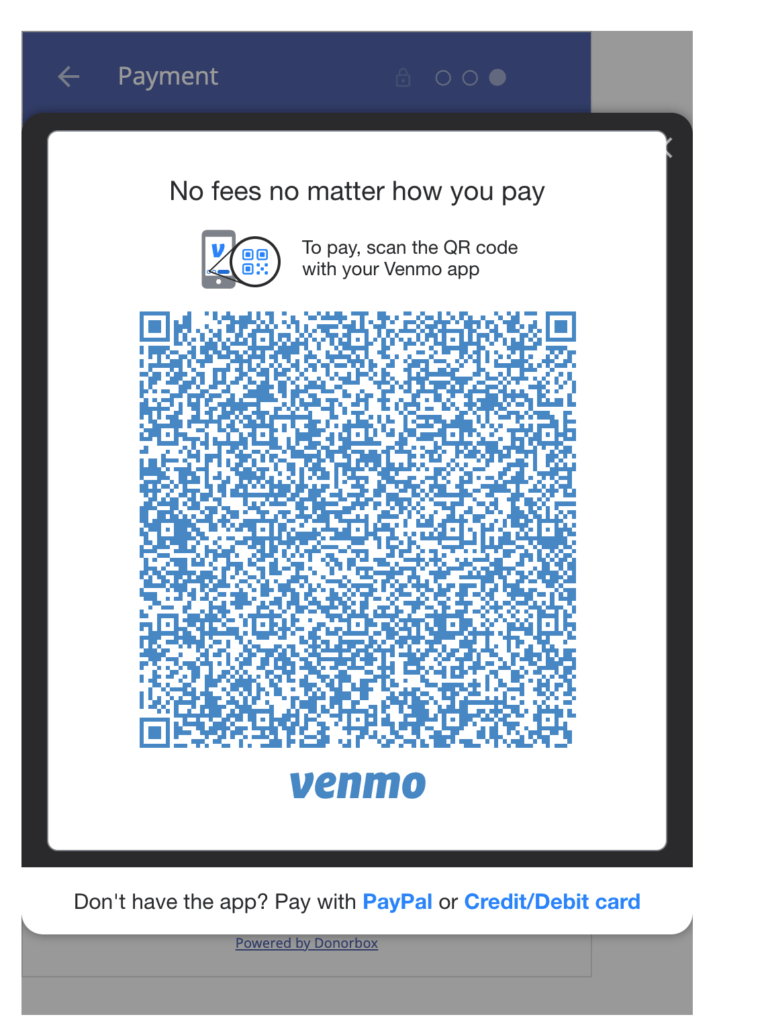

Using Venmo To Increase Nonprofit Donations Venmo For Nonprofits